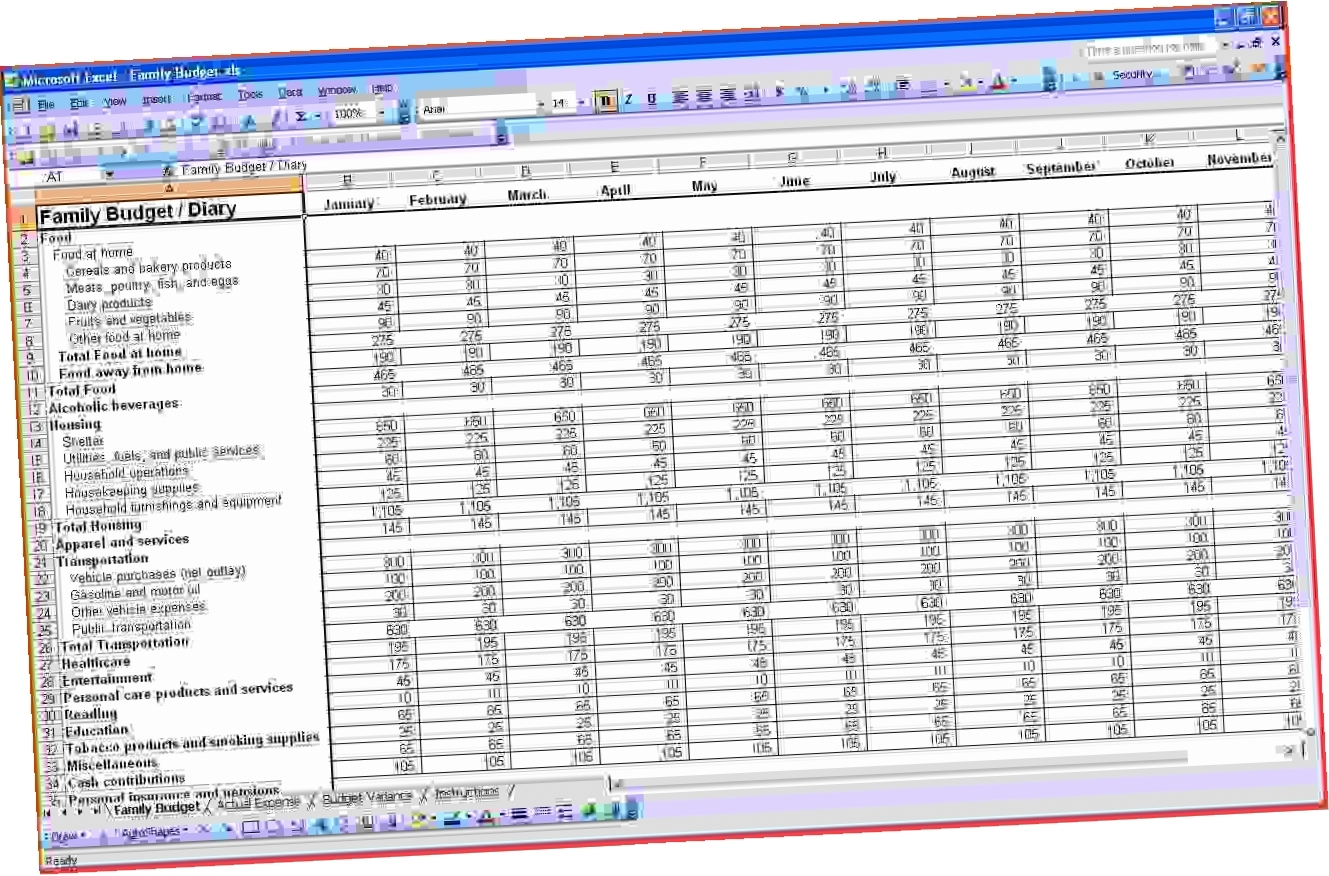

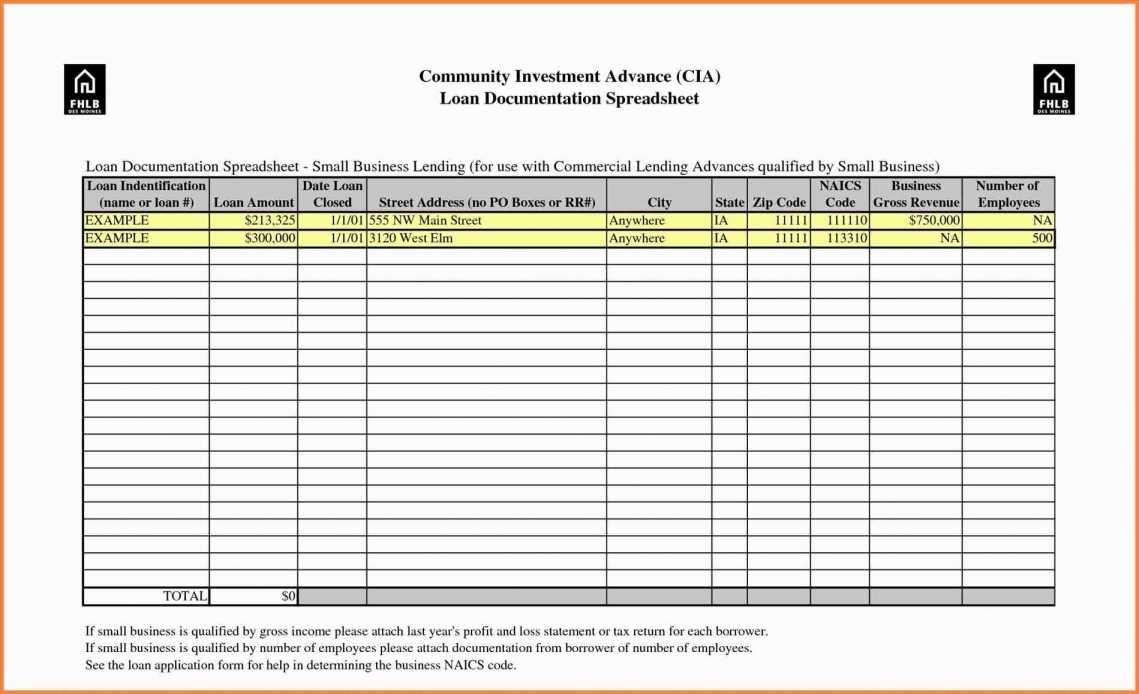

In fact, using a spreadsheet is one of two bookkeeping options available to small businesses. This can be as simple as a single spreadsheet on your laptop. Unless you're going to write everything down with a quill pen in a giant ledger, you're going to need some type of digital bookkeeping solution. Small business owners tend to have an immediate, intimate view of the business' health and profitability without needing to quantify them. A small business likely doesn't have a need for more complex financial reporting. The detailed record of inputs and outputs this method produces is sufficient for creating the relatively simple tax returns that a small business needs to submit every year. Single-entry cash accounting will likely best serve very small and simple businesses. Which Style of Bookkeeping Should You Use? Accrual accounting offers a fuller picture of assets and liabilities on your company's balance sheet, providing a better sense of your profitability. In accrual accounting, you immediately record a purchase or sale, even if no one has paid anything. So you put a purchase or sale in the books after the money has changed hands.

With cash accounting, you record each transaction when it occurs. Accrual AccountingĬash and accrual accounting differ in the timing of when you record each transaction your business makes. Single-entry accounting doesn't enable this type of analysis. It includes enough granular detail to enable the creation of all the major financial statements, such as balance sheets, income statements, cashflow statements, and more. The purpose of double-entry accounting is to provide more visibility into the workings of your business. With double-entry bookkeeping, you record each transaction twice-once as a debit from one account and again as a credit to another account. You'll need to make two decisions right away when you start bookkeeping: Will you use a single-entry and double-entry system? And will you use a cash or accrual accounting system? Single-Entry BookkeepingĪ single-entry system operates in the same manner as keeping a record in a checkbook: You simply record every input and output from your business. Bookkeeping is part of the larger process of accounting, which is focused on interpreting and presenting the data in a business's books.Īs such, the goal of bookkeeping is to provide organized, accurate financial information that accountants can use to communicate a business' financial results at the end of the year for income tax purposes and potentially for other reasons such as to provide financial information to potential investors.

Read on for bookkeeping tips to use as your business gets off the ground.īookkeeping is the process of recording every financial transaction your business makes-both income and expenditures-and keeping those records organized. Luckily, doing your own bookkeeping is usually not too difficult. Small businesses just starting out need to keep their records as accurately as any business, but they may not have the funds to hire a bookkeeper.

0 kommentar(er)

0 kommentar(er)